A local bank with a local currency

by Michael Smith (Veshengro)

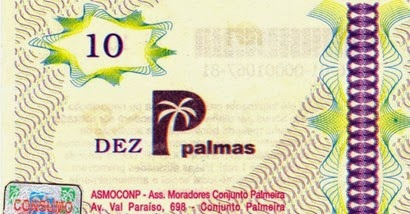

One of Banco Palmas' key innovations has been to issue a neighborhood-scale alternative currency called the "Palma". Like other local currencies, the Palma was designed to support local commerce by restricting its circulation to the Palmeira neighborhood, preventing money from leaking out of the community. The result has been impressive. To date, hundreds of local businesses have signed up to accept Palmas, while the currency has helped strengthen or create thousands of local livelihoods. Moreover, the neighborhood's spending patterns have seen a dramatic shift since the bank's founding and the release of the currency. According to one estimate, "In 1997, 80% of [Palmeira] inhabitants' purchases were made outside the community; by 2011, 93% were made in the district" (from People Money, The Promise of Regional Currencies). Another key purpose of Banco Palmas has been to extend basic financial services and access to credit to people excluded from – or exploited by – the conventional banking system. The bank provides micro-credit loans for local production and consumption in either Palmas or the national currency (the Brazilian Real). Importantly, loans issued in Palmas are interest free, while others are offered at very low interest rates, providing a much-needed alternative to the kind of predatory lenders that exploit people and businesses in other money-poor communities around the world. What's more, rather than awarding loans based on credit history, proof of income, or collateral – something many people in Palmeira lack – many are issued using a neighbor guarantee system. Banco Palma has been so successful that it has inspired the creation of over 60 similar initiatives throughout Brazil, and spurred the development of the Brazilian Network of Community Banks.

While the people of the Palmeira district set up their own community bank in other places of the globe other kinds of “alternative currencies” and local currencies are taking off and taking hold. Some are operated in such a way that they can be exchange one to one for the coin of the realm of the particular nation while others are hour-based, either as a kind of voucher (like a dollar bill) or on an account book.

In many countries such local currencies still move in a gray area and are not, necessarily, approved of by the authorities of the country and certainly not by the money-issuing banks. When it comes to crowdfunding and especially issuing of share certificates with regards to funding local businesses the legal situation, especially in EU countries can be very complex and in some countries it is a total no, no.

Even credit unions are under threat and often difficult to establish under the banking rules in many European Union countries, which are being governed, let's face it, not by the people, or so-called “elected” officials, but by the big banks and corporations.

That does not mean that we must not try and force a change of the banking system and the currency system and force the legalization of local currencies. But not so much by force but by subtlety and by simply using such a currency, especially when it could be based on things others than printed notes, for instance.

Any local currency, if it is deemed by the law of the state to be illegal to issue “banknotes” and “coins” could be a token system, as it is anyway, and using much simpler designs, using hours and parts thereof rather than a monetary value, and even wooden discs instead of paper vouchers. Let's keep it simple and not complicate things too much.

© 2014